What are Blockchain and Bitcoin?

At this time of the year, it's customary to reflect back at the year we just completed. From an investing point of view, two predominant themes stand out for 2017: Bitcoin (cryptocurrencies) and cannabis stocks. 2017 is the year that Bitcoin became a household name and we will use this issue to try and help you to understand a little about how it works, why it's become so popular and what are the risks; but, before we get to Bitcoin, we need to first discuss its underlying technology - blockchain.

What is Blockchain?

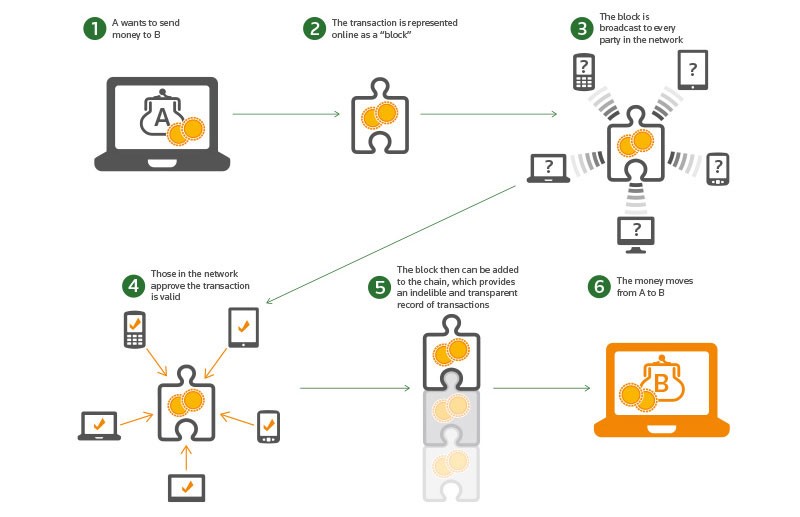

Although blockchain technology is a complicated concept to comprehend when you begin to dig deeper, its basic concept is not so difficult to understand. It's simply a database of a string of blocks (transactions) that are validated by a network of computers, rather than a central authority, like a bank or government.

Traditionally, we needed these central authorities as trusted counterparties in various contracts and transactions; however, blockchain now makes it possible to have our peers (a network of computers connected over the internet) act as the guarantor in an automated and secure fashion. A copy of the entire Blockchain is maintained on each computer in the network, meaning that no one person or entity has control over its history. The diagram below illustrates how the process works using a cryptocurrency example of transferring money from person A to person B. Step 5 shows how each new transaction is added to the previous ones thereby creating a chain.

While Blockchain technology today is most commonly associated with Bitcoin and cryptocurrencies, it has many other potentially far reaching applications.

Distributed Cloud Storage: Current cloud storage services are centralized and users must place their trust in a single storage provider who houses the online data. Using a blockchain-powered network can decentralize data storage, thus improving security and decreasing the single provider dependency. Storj is beta-testing cloud storage using a Blockchain-powered network to improve security and decrease dependency.

Digital Voting: One of the greatest barriers to moving the electoral process online is security. The blockchain would register each vote as a transaction, which would be easily countable, while the built-in audit trail would ensure no votes were tampered with. In 2014, Liberal Alliance, a political party in Denmark, became the first organization to use blockchain to vote at their annual meeting. An organization called Follow My Vote is attempting to use it for an electronic voting system that's more secure than modern versions, and health providers are starting to use it to handle patient records.

Financial Industry: Blockchain technology proponents believe it can be used to create secure and convenient alternatives to time-consuming and expensive financial and banking processes. This theory seems to be gaining traction, as almost every major bank around the world is testing it. Fraud reduction, smart contracts, and efficiencies in payments and trading platforms are just a few of the ways it could transform the industry.

Accounting: Maintaining a business accounting system is a timely and costly process, especially when audits are performed. Blockchain has the potential to automate accounting processes saving both time and money; auditing a company's books will become easier because of the built-in authentication and verification processes.

Blockchain appears to be here to stay and has the potential to fundamentally transform many industries and processes as we know them. I believe that blockchain technology will be adopted by and experimented with by an immense variety of applications across all of society over the next several years.

What is Bitcoin?

Bitcoin was proposed in 2008 as a peer-to-peer electronic cash system that allows for online payments to move globally from one party to another without going through a traditional financial institution such as a bank. It is purely a digital currency that is not backed by any government or company, nor is there any underlying asset to give it value, such as gold. Its value is derived by how much a buyer is willing to pay and how much the seller is willing to accept. There are no physical coins and it exists solely in the digital world. Bitcoins are bought and sold on electronic exchanges around the world (similar to a stock exchange).

Bitcoin makes digital transactions possible without a "trusted intermediary" by using blockchain technology. Blockchain allows this to happen at scale, globally, with cryptography doing what institutions like commercial banks, financial regulators, and central banks would normally do: verify the legitimacy of transactions and safeguard the integrity of the underlying asset. When a computer on the network confirms a transaction by solving an algorithm, it is rewarded with a small portion of a newly created Bitcoin as payment this process is known as mining and is how Bitcoins are created. The total number of Bitcoins will be capped at 21 million, which is the result of the currency's underlying mathematical structure.

Bitcoin can be exchanged for other currencies (dollars, euros, pounds, etc.), products and/or services; as of summer 2017, over 200,000 merchants and vendors worldwide accepted Bitcoin as payment, including Microsoft, overstock.com and Subway.

Written by: Hamed Murad, CIM