Retirement Income Planning CPP, OAS, and RRSP/RRIF Considerations

This week's discussion is on a couple important Retirement Income Planning considerations CPP, OAS and RRSP/RRIF Considerations.

Retirement Income Planning CPP, OAS, and RRSP/RRIF Considerations

Many client-advisor relationships are focused almost exclusively on amassing wealth. Certainly it is important to preserve and grow your wealth in order to afford your preferred lifestyle and save for the future. Then, once the future has arrived, it's time to be more focused on maintaining that preferred lifestyle in retirement. Accumulating assets is very different than generating income in retirement, though both are critical to achieving your retirement dreams.

Retirement Income Planning is the intelligent use of accumulated assets in a tax efficient manner, in order to minimize taxes and maximize government benefits, ultimately to maximize the use of assets. This process should begin years before retirement.

Retirement Income Planning requires some baseline information, some assumptions, and will generate a number of scenarios. At the end of the day it is to provide a stable and predictable plan for peace of mind. The goal is to reduce and/or defer taxes, provide income flexibility and stability, and avoid Old Age Security (OAS) claw backs.

Step 1: Determine when to take Old Age Security (OAS) and Canada Pension Plan (CPP) benefits

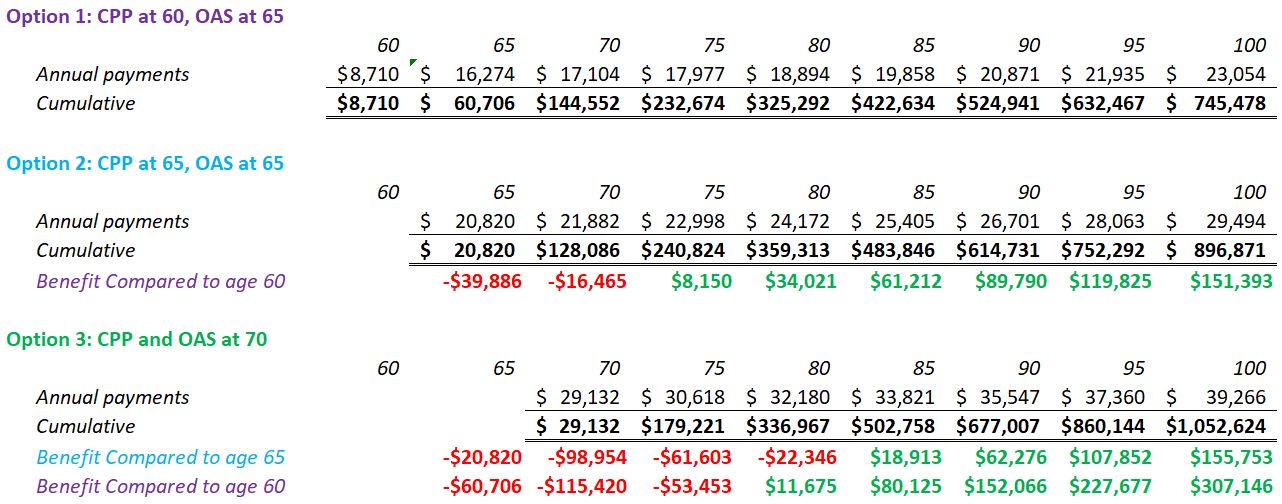

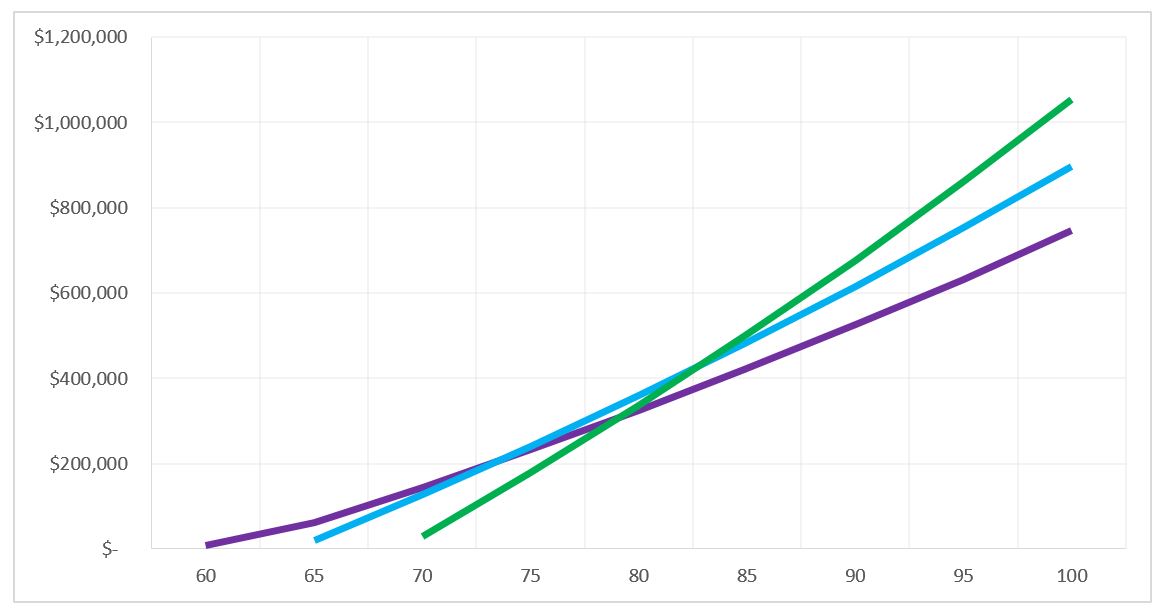

Both the OAS and CPP offer similar premiums that depend upon the age at which a recipient begins to receive payments. For each month that you defer OAS after the age of 65, the payment will increase by 0.6% a month, 7.2% a year, to a maximum of 36% by age 70 (60 months x 0.6% = 36%). This is most relevant if you work past age 65, when you become eligible for OAS and could increase your benefit rate by deferring.

For each month after the age of 65 that you defer CPP, your payment will increase by 0.7% a month, 8.4% a year, to a maximum of 42% by age 70 (60 months x 0.7% = 42%). Additionally, if you are to collect your CPP payments prior to age 65 you will have your benefits reduced by 0.6% per month to a maximum reduction of 36% (60 months x 0.6% = 36%).

Life expectancy is an important consideration in determining when to take OAS and CPP. The average life expectancy for current 65 year-old Canadians is 86 and 88 for men and women, respectively. Taken as early as possible, these government pensions will be collected for 26 and 28 years on average.

Simply put, deferring OAS and CPP a few years results in effective annual returns of 7% and 8%, respectively, every year for the rest of your life. Additionally, the current break-even point for a 60 year old to collect CPP early at age 60 is age 74; meaning if you live past 74 you are better off to take CPP at 65 vs 60. For average males living to age 86 that is a 64% pension (taken at age 60) for twenty-six years, equivalent to that of a full pension for 16.64 years. Waiting until age 65 and collecting a 100% pension for twenty-one years is just less than waiting until age 70 and collecting a 142% pension for 16 years (142% x 16 years = 22.72 years).

Assuming average health and life expectancy, it is best to defer CPP and OAS to age 70, in order to maximize your benefits. By deferring until age 70, you will receive a monthly payment of 42% more CPP than if you started receiving it at 65, and 36% higher OAS payments compared to taking it at age 65. The current break-even point for a 65 year old to collect CPP and OAS at age 70 is age 78; meaning if you live past 78 you are better off to take CPP at 70 vs 65. Plan your cash flow and income requirements, and determine if and when OAS and CPP can and should be deferred.

Note: Consider the above points before electing into OAS and CPP. When you start to receive OAS and CPP benefits you cannot elect out to stop receiving payments, in order to defer and receive a larger benefit.

Note: Consider the above points before electing into OAS and CPP. When you start to receive OAS and CPP benefits you cannot elect out to stop receiving payments, in order to defer and receive a larger benefit.

Step 2: Project your RRIF income

This is often the most confusing part of the process for investors as the conventional wisdom has been to:

contribute to RRSPs during working years to pay less in tax,

then in retirement not to convert to a RRIF until age 71 (when required to) to avoid paying tax,

convert RRSPs to RRIF at age 71 when required,

only withdraw the minimum to not pay taxes.

If your income is lower during retirement before age 71, in many cases it makes sense to convert your RRSPs to a RRIF earlier and start withdrawing to take advantage of lower tax brackets. Beyond the tax benefits, this income can also bridge the gap between retirement and age 70 where you have deferred CPP and OAS, while taking advantage of higher government benefits discussed in Step 1.

Note: When you convert an RRSP to a RRIF, you can always convert back to an RRSP before age 71 if your situation changes.

Step 3: Project your total Income

Projecting future income is important for prudent tax planning; to minimize taxes over the long-term. This involves many aspects. Today let's discuss one area that affects many Canadian's - Old Age Security (OAS) claw back. Once your income reaches $74,000, your OAS benefit begins to be reduced by 15% for every dollar earned over $74,000. This effectively taxes income over this threshold by an additional 15%. Thus, for income over $74,000, the marginal tax bracket is 31%. Including OAS claw back of 15%, the effective tax rate is 46%. For every dollar of taxable income reduced between $74,000 and $120,000, you save 46%-58% of effective taxes (as marginal tax brackets are 31%-43%, plus 15% claw back).

Step 4: Determine ways to reduce tax and increase income

This is where creativity becomes important. If you are doing well, and have invested intelligently, your pre-retirement income may be virtually the same as your post-retirement income, and tax bracket. That is to say that between income generated from your savings, CPP and OAS, you are almost at the same level of income as you were in your working years - the ideal situation.

There are strategies to reduce your taxable income to reduce or eliminate OAS claw back, such as: moving assets into a trust (while maintaining control of assets), converting RRSP's to RRIF early, income splitting, using a Tax Free Savings account (TFSA), appropriate asset location across accounts, gifting assets, annuities, and planning ahead for a future sale of a rental property.

I hope this helps shed some light on a couple considerations for minimizing taxes in retirement and getting the most out of government benefits. Planning is important to determine the most tax efficient way in ensuring that your accumulated assets deliver the income that you need, while providing flexibility for you and your family.

Andrew Brydon, CPA, CA

Wealth Counsellor