Personal Pension Plans (PPP)

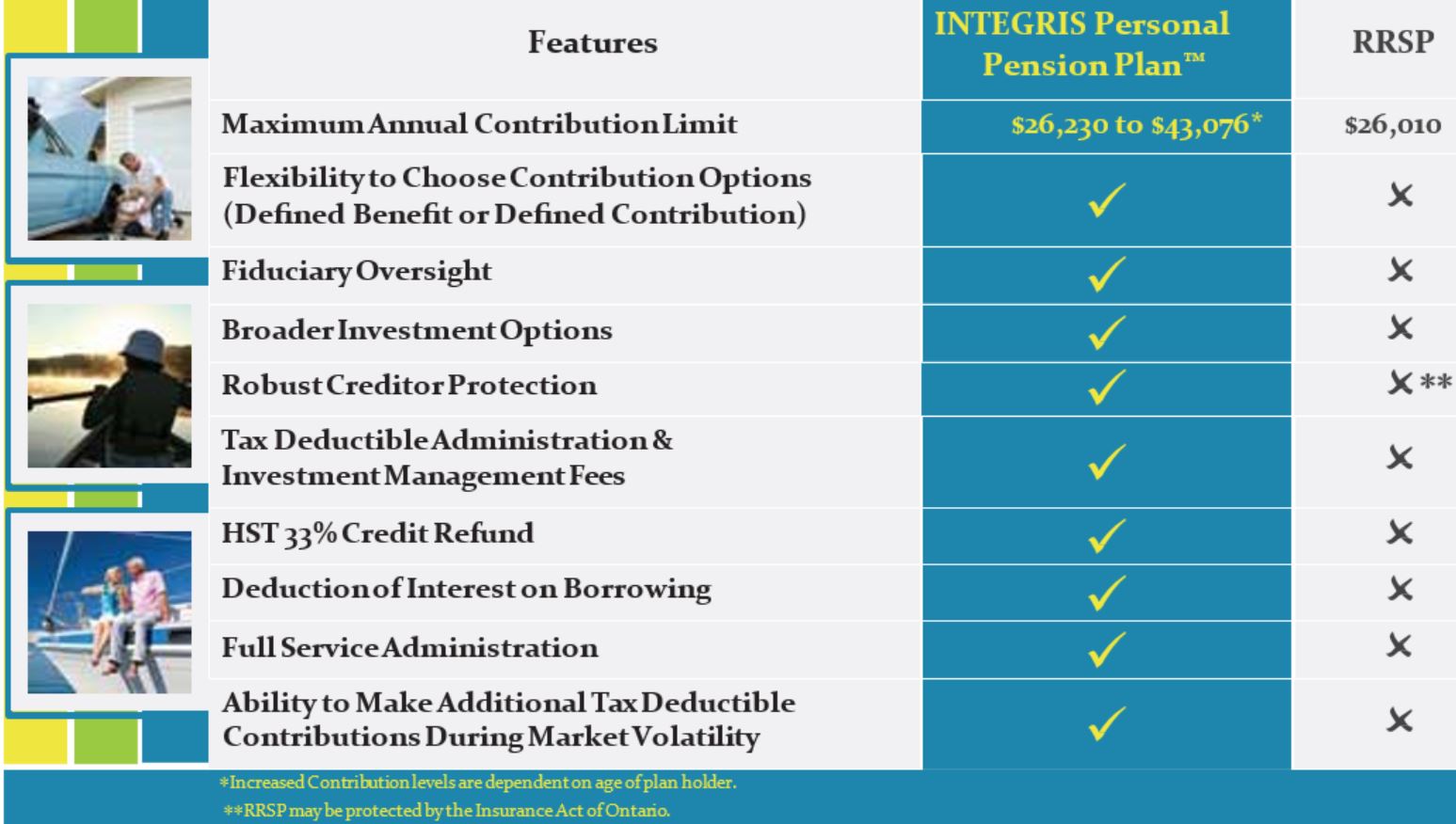

Many accountants are aware of the Individual Pension Plan (IPP). However, at Spiegel we are aware of the Personal Pension Plan (PPP), the evolution of the Individual Pension Plan (IPP), offering enhanced benefits of an IPP. It is a Canadian tax-savings solution for business owners, incorporated professionals and those retiring with a Defined Benefit (DB) Pension looking for a better way of saving for retirement and minimizing taxes. As compared to an RRSP, the PPP allows up to 60% greater tax-deferred compounding until the individual retires.

High level benefits of this solution:

High level benefits of this solution:

Shelter More Income - The ability to build a larger retirement nest-egg with increased contribution levels on an annual basis.

Safety of Your Assets - Your savings within a pension plan are protected from the claims of trade creditors and furthermore, tax-exempt roll-over of existing RRSP assets which will provide further protection of all registered assets.

Tax Deduction of Fees - The ability to deduct all investment, actuarial, administration and trustee fees related to your account from corporate income.

Mitigating Market Losses - The Pension Plan allows the sponsor to make additional tax-deductible contributions each year to top up your account if investment returns are less than expected to ensure full funding of your pension plan.

Contribution Flexibility - a combination plan that allows you to switch between Defined Benefit (DB) and Defined Contribution (DC) components to allow for changes in the economic climate of the business.

Greater Scope for Investments a PPP provides the flexibility to invest in a wide range of non-traditional investment vehicles that are otherwise not available inside of an RRSP, such as real estate.

Details of a PPP:

Details of a PPP:

Over 20 years, assuming the same rate of return on assets as earned in an RRSP, the PPP member will have over $1M more in registered assets to retire on.

There are 7 new types of tax deductions inside of a PPP that you cannot find inside of an RRSP:

Greater annual deductions ranging from $1,437 at age 40 to $17,066 by age 64 and beyond.

Terminal funding to enhance the basic pension.

Ability of the corporation to make tax deductible contributions to assist in the purchase of past service, thereby lowering current corporate taxes.

Special Payments (also tax deductible by the corporation) if the assets of the pension plan don't return 7.5%.

Interest paid to lenders for contributions made for the PPP are tax- deductible.

Investment management fees paid on any asset inside of the PPP are tax- deductible.

Administration, trustee, actuarial fees are tax deductible.

Assets inside a PPP are trade creditor protected.

Required contributions owed by the corporation to the PPP are provided super priority in a bankruptcy and rank above secured creditors like the banks.

Assets inside of a PPP can pass from generation to generation without triggering a deemed disposition and because the funds do not end up in the estate, there are no probate fees or estate taxes.

Transfers of commuted value pensions from large defined benefit pension plans to a PPP (DB Component) do not generate any excess amount tax as normally found due to Income Tax Regulation 8517 triggering immediate tax savings to terminated employees.

Pension Plans can avail themselves of the HST Pension entity Rebate (33% of all HST paid in connection with the pension plan is refunded to the corporation).

While IPPs must cease all tax-deductible contributions if they are over- funded (considered in excess surplus), under a PPP, the plan member can switch to the DC/AVC components, and while no contributions can be made to the DC account, the full 17% of salary can be made by the member.

Double-dip: Out of the same $100,000 salary, in the year of plan set up, a plan member could make an $18,000 PPP contribution and a $18,000 RRSP contribution if that person had no earned income in the year 1990.

Unlocking: not only are AVC assets unlocked at all times (by eliminating the AVC provisions from the plan text), but by reducing accrued benefits and creating surplus, additional funds can be withdrawn.

U/L add-on: The large tax savings / refunds created by the multitude of additional tax deductions could be used by the corporation to purchase an overfunded universal life (U/L) policy with the corporation designated as the death beneficiary thereby funding the policy with $0.00 cost.

Early retirement: as early as age 55, with pension income splitting and $4,000 worth of pension being eligible for the pension tax credit. RRIF income splitting only starts at 65.

Flexibility: being able to switch between DB and DC every year helps control pension costs. But the superior tax deductions afforded DB plans isn't lost in a year since the plan can be amended to convert DC into DB years.

Fiduciary and Governance: INTEGRIS offers a "pension committee" service to ensure compliance and supervision with pension officers, compliance staff and lawyers at no extra cost.

Purification for life the time capital gains exemption: deductions created inside the company when purchasing past service, borrowing or doing terminal funding/special payments, can purify a corporation to the exemption ($835,714).

If you hold a corporation or are approaching retirement with a Defined Benefit Pension Plan, a PPP is likely beneficial to you for many reasons.

Written by:

Andrew Brydon, CPA, CA

Wealth Counsellor