New Investment Reports on Fees and Performance: Are You Getting the Total Cost?

This article will be brief, albeit cover an important topic about understanding the changes in 2017 surrounding the reporting and transparency of performance and costs of wealth management advice. Phase 2 of the Client Relationship Model (CRM2) has been a move in the right direction of transparency for Canadians. Many Canadians whose Financial Advisors are not fee based will see new reports in 2017 as a result of CRM2, and will now be aware of the cost of advice and fees being paid to their financial advisors, such as commissions from mutual fund companies, as well as the performance of their investments.

First are new performance reports. It is now mandatory that firms disclose the historical money-weighted rates of return, thus more transparency on performance. The shortfall unfortunately is that there is no mandatory start date for reporting returns. It was recently reported in the Globe and Mail that one advisor heard chatter that some firms are selecting to show returns starting between 2008 and 2011, between the start of the global financial crisis and during the bull market recovery that resulted thereafter. Clearly starting from any of these points does not cast a clear light on how a portfolio is positioned to handle bear markets. We often meet families in their 60s, 70s and even 80s, whose portfolio consists of 70-80% equities. Such portfolios have done well the past 8 years, after being down approximately 40% in 2008-2009.

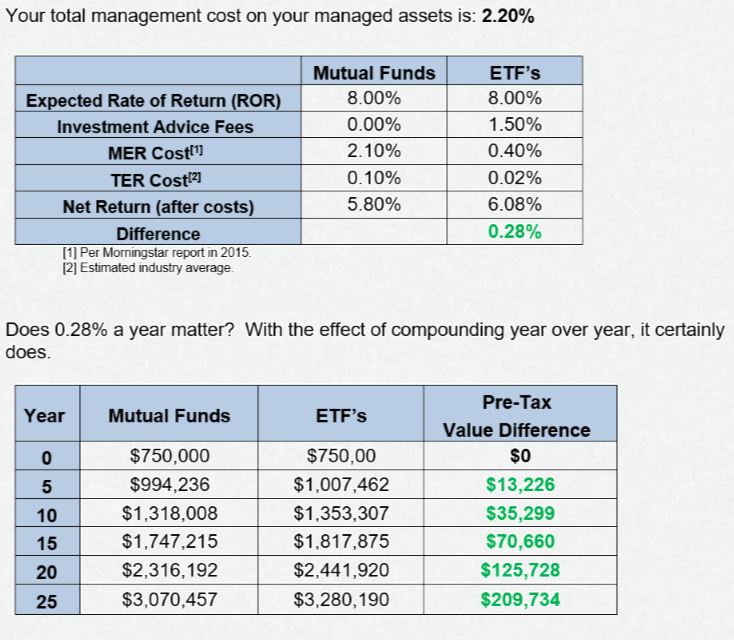

Performance is certainly important, yet only half of the equation. Some Canadians may think that performance, not planning and advice is the value an advisor delivers. The new reporting statements may cause people to focus on only half the story, performance, not planning and advice. If your advisor has not disclosed upfront what the total cost of your investments will be, you will now see part of the total fees - the fees for services (planning, advice, dealer fees etc.), however mutual fund operation and management fees are not included in the new statements as they are not part of the core mandate of CRM2. Thus, the total cost of investments (and planning) are not disclosed in these figures if you hold investments such as mutual funds, hedge funds and ETF's, as they have underlying operation and management expenses. The total cost within a fund is comprised of the Management Expense Ratio (MER) and the Trading Expense Ratio (TER). Keep in mind, if you hold DSC (Deferred Sale Charge) mutual funds, your advisor likely received 5% upfront when they invested you in a DSC fund, and approximately 0.25% a year thereafter. You will not see this upfront fee on your new statements if the trade was made prior to 2016.

What does the word "total" mean to you? "Total" according to Webster's dictionary is "comprising or constituting the whole, or entire amount". The synonyms are entire, complete, whole, full comprehensive.

When advisors are not transparent of the MERs and TERs within a client's portfolio, you are not able to understand the total cost of managing your wealth. So how will Canadians know if the new reporting is the total cost or not? Statements will say "total charges and compensation". If it is not the total, then what is the total? What is not included?

You can perform a portfolio fee audit exercise to understand your total cost of advice. Be sure to include the fees you pay for advice and the MERs and TERs on any mutual funds, hedge funds and ETFs that you hold.

Once you understand your total cost of advice, you can then consider the value you receive from your advisory team. Do you have a quality financial plan? I am not talking about a simple plan to sell products, such as mutual funds and life insurance. A quality comprehensive financial plan encompasses your goals and values, and is updated on an annual basis. A comprehensive plan covers all aspects of financial planning, and includes:

Tax Planning

Retirement Income Planning

Wealth Transition & Estate Planning

Risk Management/ Insurance Protection

Global Investment Management

Reviewing and Drafting Wills and Powers of Attorney

Business Transition Planning

Philanthropic Strategies

Estate Settlement & Management

At Wealth Stewards, we are proud that long before CRM2 we have been upfront and transparent about the total fees for our advice. We believe that every Canadian rightly deserves transparency. If we can help you understand your total cost of managing your wealth or the value of the advice you are receiving, we can perform an Initial Assessment & Evaluation. Our Initial Assessment & Evaluation process allows us to gather an overall understanding of your personal situation in order to objectively assess if there are areas of your financial planning that can be enhanced, which includes a portfolio audit such, such as this:

Written By:

Written By:

Andrew Brydon, CPA, CA

Wealth Counsellor