Investing in Volatile Markets & Alternative Investments

Investors who may be feeling whipsawed after the increase in volatility may be wondering, "How can I better protect my portfolio from the ups and downs in the market?" The first answer is simple: diversification. A properly diversified portfolio will contain a collection of securities, some of which will have low to preferably negative correlations to other securities held. What does low or negative correlation mean? This means that when one security goes down (e.g. stocks) another security either goes down very little or may even rise, thereby offsetting the effect of a drop in the stock market.

Typically, fixed income has been used as one of the main asset classes to off-set the volatility of equities, however, just because a bond moves in the opposite direction to a stock one day, doesn't mean it will do the same when the market takes a sudden and severe drop. We could potentially be heading towards a perfect storm in bonds if stock markets were to drop at the same time as rates are rising, thereby multiplying the effects of volatility - the exact opposite to the function of holding traditional bonds in a portfolio.

We believe we will experience more volatility in the short-run given numerous risks, including:

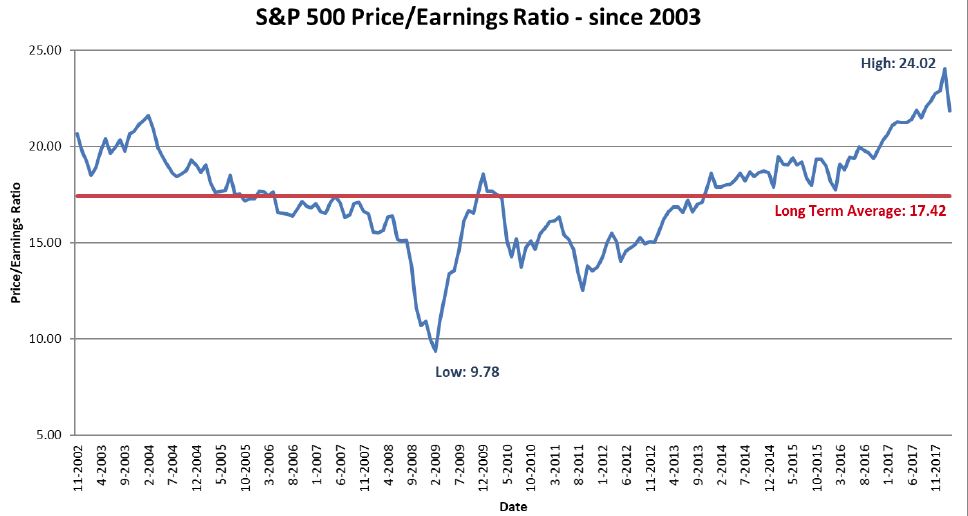

the continuing bull market (the January correction didn't end it) and still relatively high historical valuations, even though they have fallen slightly this past quarter;

the uncertainty if the U.S. Fed may raise rates in 2018 beyond the expected three times and thus the short-term effect on bond prices;

data privacy issues for technology companies and what future data privacy regulations will entail;

rising concerns over hastily imposed tariffs on U.S. imports which could escalate into a global trade war (you may recall the effect on the U.S. economy when in 1987 President Reagan imposed 100% trade tariffs on Japanese imports or be aware of when in 1929 President Hoover signed the Smoot-Hawley Tariff which crumpled the stock market and triggered the Great Depression);

Russia's escalation of its reckless meddling around the globe, and

Donald Trump's compounding legal issues and the resulting chaos in his administration are just a few of the current risks.

However, not everything is all doom and gloom as there are numerous positive aspects that cannot be overlooked: last year's tax cuts in the U.S.; both Canada's and the U.S.'s strong GDP growth in 2017 and the expectation that it will continue in 2018, along with growth in international developed and emerging economies that signal the end to unprecedented economic easing by major central banks worldwide.

However, not everything is all doom and gloom as there are numerous positive aspects that cannot be overlooked: last year's tax cuts in the U.S.; both Canada's and the U.S.'s strong GDP growth in 2017 and the expectation that it will continue in 2018, along with growth in international developed and emerging economies that signal the end to unprecedented economic easing by major central banks worldwide.

How do we manage volatility in portfolios? First, by holding a globally diversified equity allocation, augmented by a small allocation to gold bullion, however, our main tactic against volatility is alternative fixed income. Â Alternative investments employ strategies which have little or no correlation to the stock market, and provide a stable foundation to help portfolios weather market volatility. While one may immediately think of equity hedge funds when they hear the term Alternative Investments, the area of fixed income alternatives can be a very attractive niche. Potential returns may be higher than traditional bonds and some may even approach that of equity-like returns, but without similar volatility.

Some examples include:

Mortgage financing to borrowers that are under-serviced by large financial institutions;

Large scale lot development financing in major US urban markets;

Financing movie and TV production secured by government grants, completion insurance and other forms of guarantees;

Short-term inventory and working capital financing to various industries;

Lending to private companies secured by lender's assets.

Fixed income is ideal for niche and alternative investments, especially when private placements are the main focus. Interest rates are now expected to begin to rise at a slightly faster pace which means that bond yields must also rise - when this happens, bond prices fall. As a result, volatility is increased in what is supposed to be the lowest volatile part of the portfolio.

Prudent investing is important, and so are appropriate expectations. We remember that stock we purchased that made 40% in a few months, while we don't want to recall the Blackberry's, Nortel's, Valeant's, etc. that went down over 90%, nor do we want to recall the 43% drop in the U.S. stock market in 2007/2008. Stock market returns are not an appropriate benchmark. They are the performance of equity markets over a given time period. The right benchmark is the return that allows us to meet our goals - balancing risk, reward and volatility, to ensure that what we wish to happen, will happen.

If you've ever taken a long road trip, you know that conditions along the way can change quickly and unpredictably, which is why you need a vehicle that's ready for the worst roads as well as the best. While diversification can never completely eliminate the impact of bumps along your particular investment road, it does help reduce the potential outsized impact that any individual investment can have on your journey.

As we are currently in the second longest bull market in history, it is prudent to consider the uncertainty and potential downside risk. Warren Buffet's two rules of investing are important:

Never lose money.

Never forget rule #1

As a valued client, rest assured that our portfolio management team continuously makes adjustments to your portfolio on a discretionary basis based on our outlook of the markets and focuses an appropriate portion of your portfolio to unique alternative investments in order to ensure that regardless of the ups and downs of the markets your portfolio has more stable, predictable returns. Warren Buffet's two rules are paramount to us, while helping you meet your goals and achieving peace of mind. That, in turn, helps you stay in your chosen lane and on the road to your investment destination.

-

Andrew Brydon, CPA, CA

Wealth Counsellor