Highlights of the 2018-19 Federal Budget

Yesterday, Tuesday, February 27, 2018, the Federal government announced the 2018-2019 budget. Certainly you have heard some of the highlights in the media. As a valued client of the Wealth Stewards group, we wish to summarize the most important changes that may affect your family and your business.

Bill Morneau, Federal Minister of Finance, titled the budget "Equality and Growth for a Strong Middle Class".

He stated,

Mr. Speaker, [this budget] is a plan that puts people first. That invests in Canadians and in the things that matter most to them. It's a plan that builds on the hard work of Canadians, and that keeps us squarely focused on the future.

Today, Canada leads all the other Group of Seven (G7) countries in economic growth and Canadians are feeling confident about the future. That's why we are able to invest in the things that matter to Canadians, while making steady improvements to our bottom line.

First let's reflect on a few key questions we had last year after the 2017 Federal budget was released.

What will the US tax environment be?

Update: we now know the US is lowering corporate taxes significantly, increasing the competitiveness of companies doing business in the US vs Canada. The 2018-19 budget did not include meaningful measures to address Canada's tax competitiveness.

What will the US's stance be on trade policies?

Update: remains uncertain as NAFTA negotiations are ongoing

What was the impact of the announced spending measures from last year?

Update: Canada's GDP grew 3.0%1 in 2017, in contrast to 3.60%1 in 2016.

Overall the themes of the 2018-19 budget are:

Investment in innovation

Sustainable economy

Creating opportunities for the middle class

Addressing gender-based inequality

As expected, gender equality was a main theme of the 2018-19 budget. The word "gender" was used 358 times. In the Liberals first budget, 2016, the word "gender" was used twice. According to the government, every single decision on expenditure and tax measures was informed by a gender based analysis.

What was not included in the budget was a plan to address Canada's competitiveness in the global economy. Considering the US is lowering corporate tax rates, which will be lower than in Canada, making the US more attractive for businesses to operate in, the government did not announce any changes to corporate tax rates. It is waiting to see the outcome of ongoing NAFTA negotiations.

The 2018-19 budget proposed another deficit of $18.1 billion, with no plan to balance the budget going forward. Projected future deficits were again centered on maintaining a debt-to-GDP ratio of 30.1%, and lowering debt-to-GDP to 28.4% in 2022-23, with a deficit of $12.3 billion.

The good news is that the government has lowered projected deficits from those forecasted in 2016 and 2017.

.png) Source: Federal Budget 2018-19

Source: Federal Budget 2018-19

Overall Matters:

Gender equality

New measures to encourage greater participation of women in the work force, including:

$1.65 billion in financing for women entrepreneurs over three years, with a target that 15% of small to medium businesses supplying the government are firms owned by women

Pay equity legislation for employees in the federal government and federal regulated sectors, however details of a timeline and total dollar amount were not disclosed.

.png) Source: Federal Budget 2018-19

Source: Federal Budget 2018-19

Parental leave

A program to encourage men to take parental leave of up to five weeks. Estimated cost of $1.2 billion over five years. It is meant to encourage parents to share the responsibilities of raising a child and provide mothers greater flexibility to return to the workforce sooner.

Indigenous issues

A proposal to invest $447 million to create an Indigenous Skills and Employment Training Program over five years, focused on training for higher quality and better paying jobs to help close the pay gap. Also $1.4 billion over six years is proposed for First Nations child and family services.

Pharmacare

A pharmacare advisory council will perform an economic assessment on the possibility of a national pharmacare program. This is a response from a 2016 Budget Office analysis which estimated that a national pharmacare program could result in $4.2 billion a year in savings on prescription drugs as governments would have stronger position in price negotiations.

Research and innovation

The budget proposes $3.8 billion more over the next five years for fundamental research in life sciences, social sciences and health sciences. This will result in approximately half a billion more a year than today, albeit shy of the $1.3 billion recommended increase from an independent review of Canada's fundamental science ecosystem in 2017.

The budget also increased the funding of business innovation programs through a new Industrial Research Assistance Program, committing $700 million over five years. It also proposes $572.5 million to give researchers more access to advanced computing and big data resources.

Cybersecurity

Canada's cybersecurity strategy was last updated in 2010. With the prevalent increase in cyberattacks, the government allocated $508 million over five years to create a new Canadian Centre for Cyber Security and National Cybercrime Coordination Unit for the RCMP. Some observers have commented that Canada requires up to $1 billion to update cybersecurity efforts.

Journalism

The budget proposes $50 million to non-government journalism organizations in underserved communities.

Cannabis

The budget includes another $62.5 million for public education campaigns on the dangers of drug use, adding to the $46 million previously announced for at risk and indigenous communities, and $10 million on research assessing the impact of cannabis on mental health.

Personal Tax Matters:

No changes to personal tax rates. The highest tax rate remains at 53.53%. Tax brackets will continue to be indexed to inflation.

Medical expense tax credit: eligible expenses have been expanded to include expenses related to service animals to those with a severe mental impairment.

Mineral exploration credit for flow-through shares: the 15% federal tax credit has extended to March 31, 2019. It was scheduled to expire March 31, 2018.

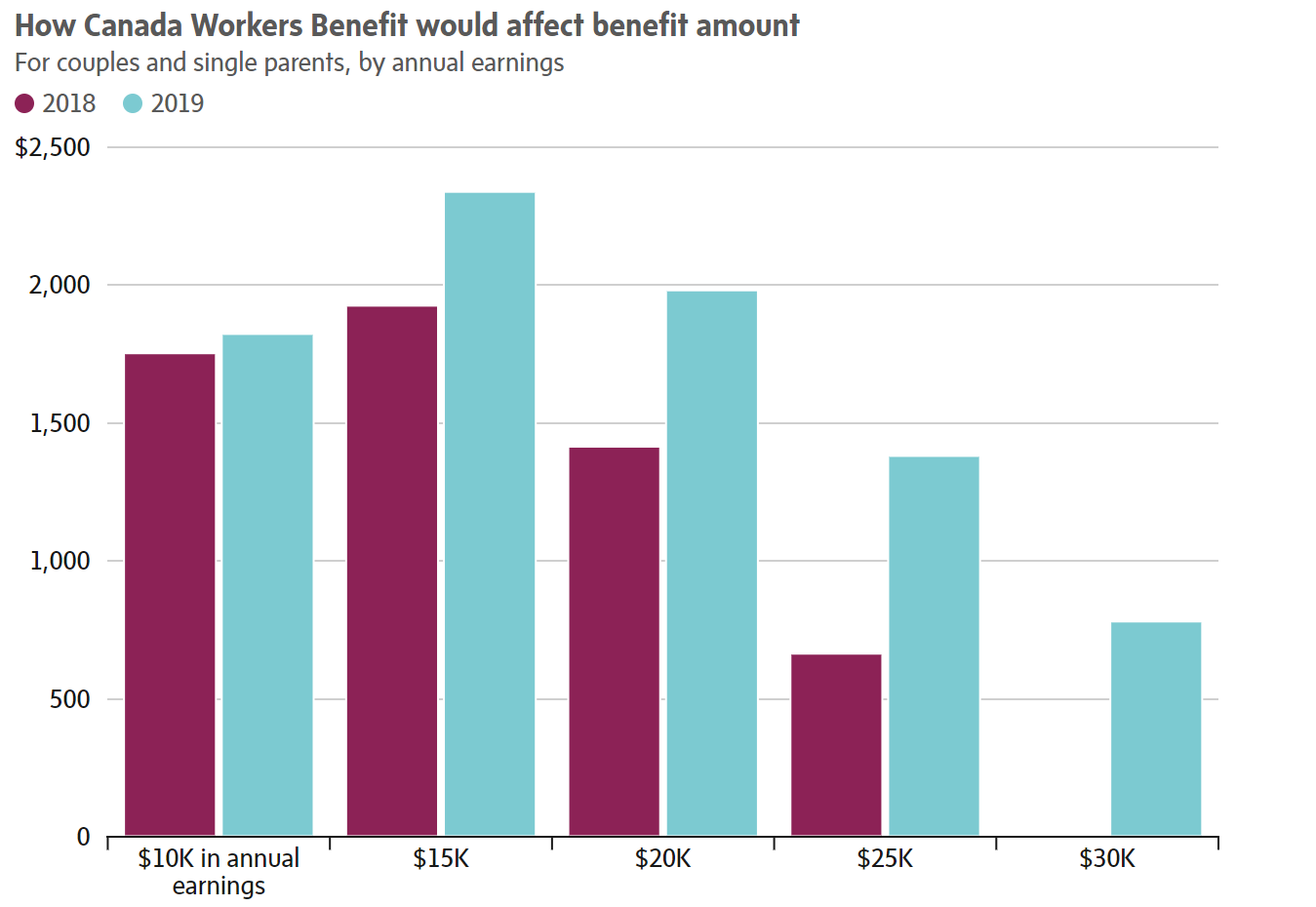

Canada Workers Benefit will replace the Working Income Tax Benefit, increasing the maximum benefits and after-tax income of low income families.

Source: Federal Budget 2018-19

Source: Federal Budget 2018-19

Business Tax Matters:

Small Business Tax

As previously announced, the small business deduction on active business income (non-investment income) will decrease from 10.5% to 10.0% in 2018, and to 9% as of 2019.

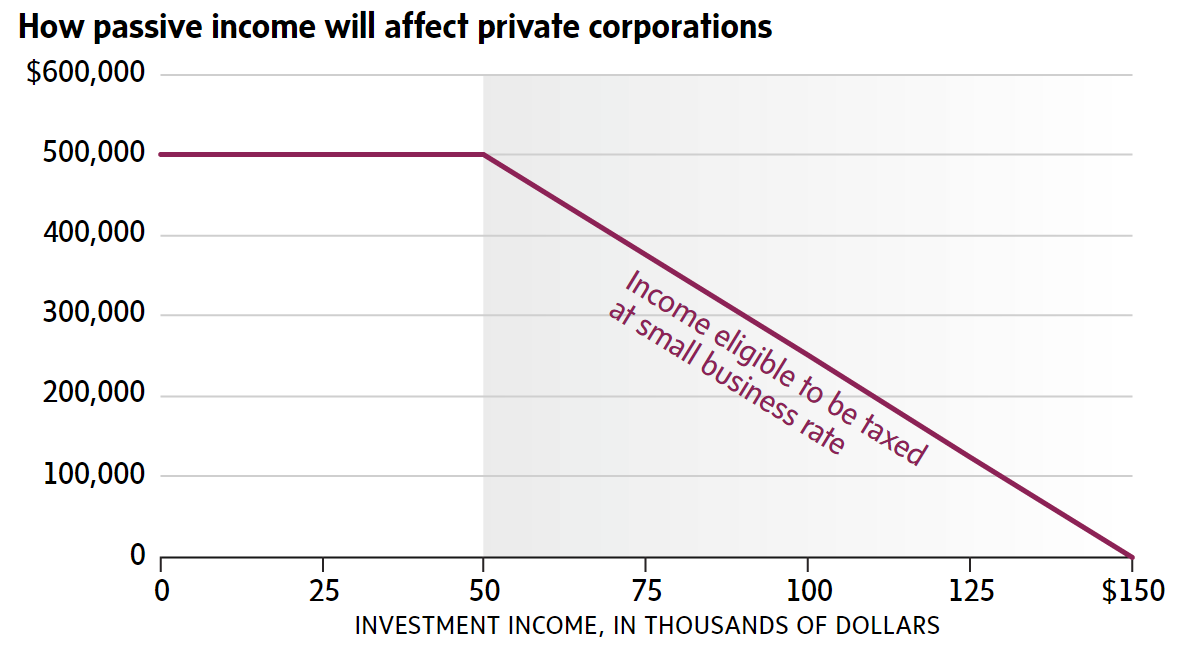

Passive (Investment) income in private corporations

The government provided further details on the taxation of passive income in a corporation. Passive income greater than $50,000 a year will lower the amount of active business income eligible for the small business tax rate, by $5 for every $1 of passive income above $50,000. Thus, corporations with $150,000 or more in passive income are not eligible for any active income to be taxed at the small business tax rate.

Source: Federal Budget 2018-19

Source: Federal Budget 2018-19

Income Sprinkling

The budget included the changes to income sprinkling measures previously announced in December 2017. Click here for details in our previous blog post.

Note: There are other detailed business tax changes related to cross border tax issues, transfer pricing and international tax treaties which are not as impactful.

This is a high level summary of the budget announcements that may have an effect on your family. As always, if you wish to discuss any of the 2018-19 Federal Budget matters in more detail, do not hesitate to call us.

- Andrew Brydon, CPA, CA

Wealth Counsellor,

1Source: https://tradingeconomics.com/canada/gdp-growth-annual