2018 - Investing in the Current Climate - Prudent Strategies and Alternative Investments

2017 was a good year in the equity markets across the board and we saw positive returns across all equity sub-asset classes, with international and emerging markets being the strongest. International gained 17.4%, emerging markets 28.7%, the US 13.2% and Canada 9.1%.

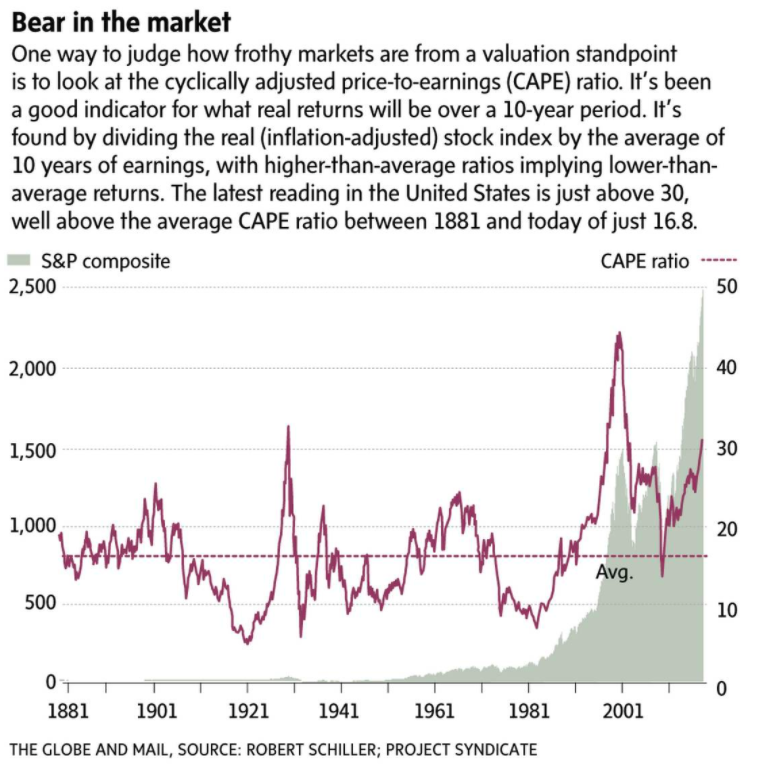

The question weighing on everyone's mind is how long can this last? While no one can know for sure, there are a couple of points to bear in mind. The US market is the most overvalued relative to international and emerging markets, with Canada less so; however, this doesn't mean the US market cannot go higher from here. The current price-to-earnings ratio for the S&P 500 was 25.06 at year end, but was over 44 in May, 2002. While 25 is high, it is certainly not in unchartered territory.

The new tax legislation passed in the US before Christmas added more good news to the markets along with the already strong economic growth, low unemployment, and low and contained inflation. There is a positive outlook on the market and if future news events remain positive, the markets can very easily continue to climb.

In the short-run, however, it is highly likely that we will experience a pullback given the market's run-up over the last couple of months and into February. Pullbacks are part of a healthy bull market as the market cannot go up every day, it needs to catch its breath.

Even though economic news has been quite positive, we must remain vigilant to unexpected events that could turn market sentiment on a dime: higher than expected inflation, a surprise rate hike from the Fed, a sudden and significant drop in the market that spooks investors, are just a few potential scenarios that could send the markets into a correction.

We are watching market events and the news for these possible risks and are ready to react in a measured and precise manner to a significant increase in risk and change in sentiment.

Canada: The S&P/TSX Composite rose 4.5% this quarter with value leading the way, up 5.7%; large caps advanced 4.9%, small caps were up 4.7% and growth stocks returned 3.5%.

United States: This past quarter was so strong that Q4 returns represent a significant portion of the returns for the whole year. US stocks gained 6.5% the last quarter with growth stocks advancing 7.8%; large caps were up 6.3% and small caps gained 5.3%; value returned 5.3%.

International & Emerging Markets: International and emerging markets were the star performers this year. International stocks were up 4.5% with large caps up 4.2%, small caps up 6.3%, growth up 3.5% and value up 5.5%; emerging markets advanced 7.7%.

Alternative Investments that employ strategies which are not correlated to the stock market are a prudent strategy to weather volatility. While one may immediately think of equity hedge funds when they hear the term Alternative Investments, the area of fixed income alternatives can be a very attractive niche. Potential returns may be higher than traditional bonds and may even approach that of equity-like returns, in some cases, but without similar volatility. Some examples include:

Mortgage financing to borrowers that are under-serviced or ignored by large financial institutions;

Private equity in Canadian private companies: Including pharmacies, in-home prescription tracking dispensaries, pet pharmacy and convertible debt in various companies;

Private corporate debt that includes options for future equity participation: 8%-10% annual interest with warrants to purchase 10% equity (shares);

Retirement residence development projects - Specializing in Alzheimer and dementia facilities

Short-term inventory and working capital financing to various industries;

Purchasing life insurance policies from individuals who no longer want or need them.

Alternative Fixed Income: This past year saw all alternative fixed income funds beat the benchmark of the FTSE TMX Canada Universe Bond Index, which was up 2.5%. Our Private Company Debt was up 5.9%, Media Loans up 8.8%, US syndicated mortgages up 9.5% and our Stewardship Alternative Income Fund (SAIF) was up 3.3%. SAIF's performance lagged due to a large cash balance but this will be alleviated in 2018 as new investments were initiated within the last few months. The second factor is several longer term investments are currently held at book value as they are still in the early stages and are not expected to start yielding results until they reach closer to maturity.

Economic News: Chalk one up for Donald Trump, the tax reform bill was signed into law on December the 22nd after quite the rollercoaster ride. JPMorgan believes this will add further fuel to the market rally in the US that seems to know no other direction but up.

Economic growth is strong in both Canada and the US and unemployment is falling. December unemployment fell to 5.7% in Canada, which is a 40 year low; in the US, jobless claims fell to their lowest level since February, 1973.

As mentioned in last quarter's newsletter, the OECD's latest numbers are predicting strong global economic growth through to the end of 2019: 3.7% in 2018 and 3.6% in 2019. Canadian growth is expected to hover around 2% per year while the US is predicted to be just over 2%.

Although equity markets have high valuations, especially in the US, the combination of positive global growth across all major regions and US tax reform has the potential to keep the rally going. With valuations at such high levels, the risk of a correction grows, but rest assured that we are carefully monitoring the valuations and reducing risk when and where we feel is appropriate.

- Andrew Brydon, CPA, CA